Trust accounts are used by law firms to keep a separate tally on customer dollars. In general, states have strict accounting rules that require attorneys to deposit unbilled/unearned client funds in trust accounts. EnterYourHours.com have functionality that allows you to track deposits to and payments from a trust account.

EnterYourHours.com does not offer legal advice pertaining to the legal requirements for trust accounts, nor does EnterYourHours.com guarantee that the functionality contained within complies with your particular state's regulations.

The first step to using trust accounting is turning on the "Allow Trust Account Entries" feature in the Settings->General Screen:

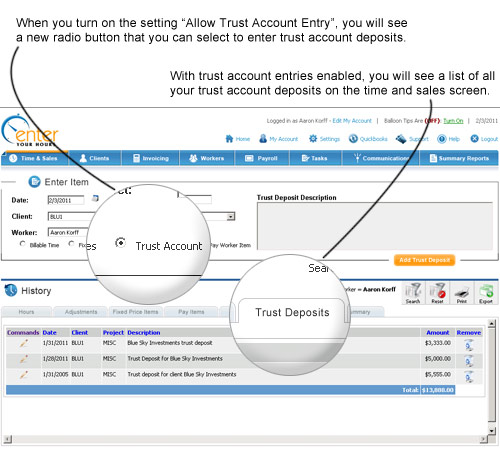

Once you select the option "Allow Trust Account Entries" and save it, you'll be able to enter Trust Account deposits in the Time & Sale Screen, as shown in the screenshot below:

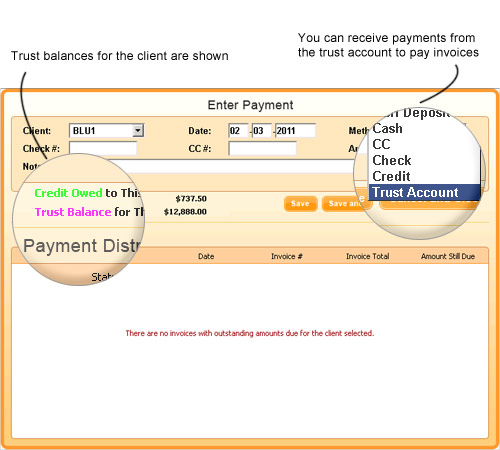

You can enter a payment for any invoices that you send to your clients by using the balance in their trust account. As long as you have the "Allow Trust Account Entries" turned on, the Enter Payment screen will have a trust account balance for the selected client, as well as a Trust Account payment type option.

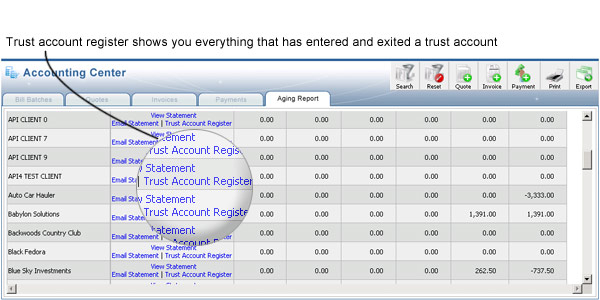

You will also have access to a report type called the Trust Register that documents the flow of money into and out of the trust account for a particular client.